|

With the development of economic globalization, all enterprises face is no longer a relatively small market, but a global market. The end of nineteenth Century, the developed countries enterprises have to expand the scale of enterprises, for a bigger share of the global market as its strategic objectives, along with the growing wave of mergers and acquisitions. The western developed countries through mergers and acquisitions quickly development of a number of large-scale enterprises, control a lot of market resources in the global scope, promoted the rapid development of economy. Since joining the WT0, China's enterprises have set off round after round of mergers and acquisitions, mergers and acquisitions strategy adopted by more and more enterprises. But M&A is a systematic engineering, involving a variety of factors of enterprises, risk of M&A is very big. In this process, the majority of enterprises due to excessive optimism and self-confidence, are often vulnerable to the temptation of short-term interests and stimulation of competitors, ignore the law, greedy big, hot pursuit, eventually ended in failure.

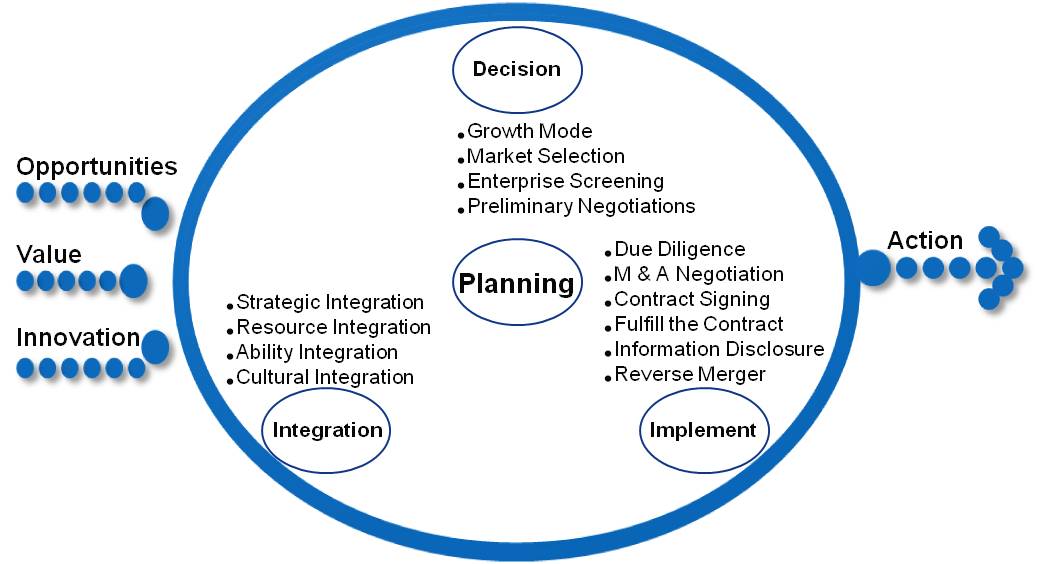

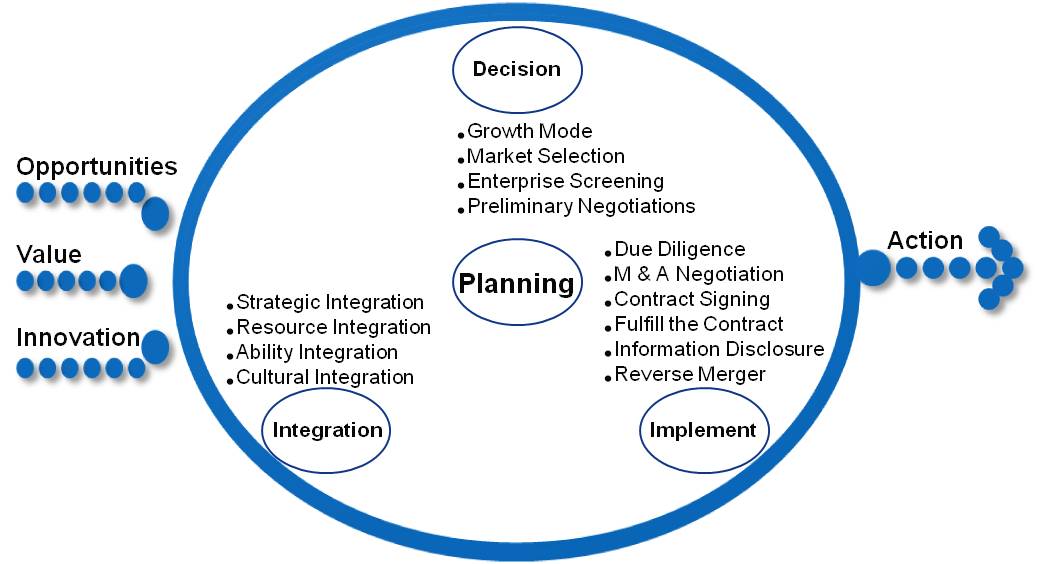

The entrepreneurial organization needs a set of scientific and effective method to guide the process of M&A, in order to form a complementary advantages, resource sharing, coordinated operation of the system, so as to realize the value goal of M&A.....

Mergers and acquisitions consulting programme of SLEEING

|

|

|Business training More+

|