Mergers and acquisitions consulting demand

With the development of economic globalization, all enterprises face is no longer a relatively small market, but a global market. The end of nineteenth Century, the developed countries enterprises have to expand the scale of enterprises, for a bigger share of the global market as its strategic objectives, along with the growing wave of mergers and acquisitions. The western developed countries through mergers and acquisitions quickly development of a number of large-scale enterprises, control a lot of market resources in the global scope, promoted the rapid development of economy. Since joining the WT0, China's enterprises have set off round after round of mergers and acquisitions, mergers and acquisitions strategy adopted by more and more enterprises. But M&A is a systematic engineering, involving a variety of factors of enterprises, risk of M&A is very big. In this process, the majority of enterprises due to excessive optimism and self-confidence, are often vulnerable to the temptation of short-term interests and stimulation of competitors, ignore the law, greedy big, hot pursuit, eventually ended in failure. The entrepreneurial organization needs a set of scientific and effective method to guide the process of M&A, in order to form a complementary advantages, resource sharing, coordinated operation of the system, so as to realize the value goal of M&A.

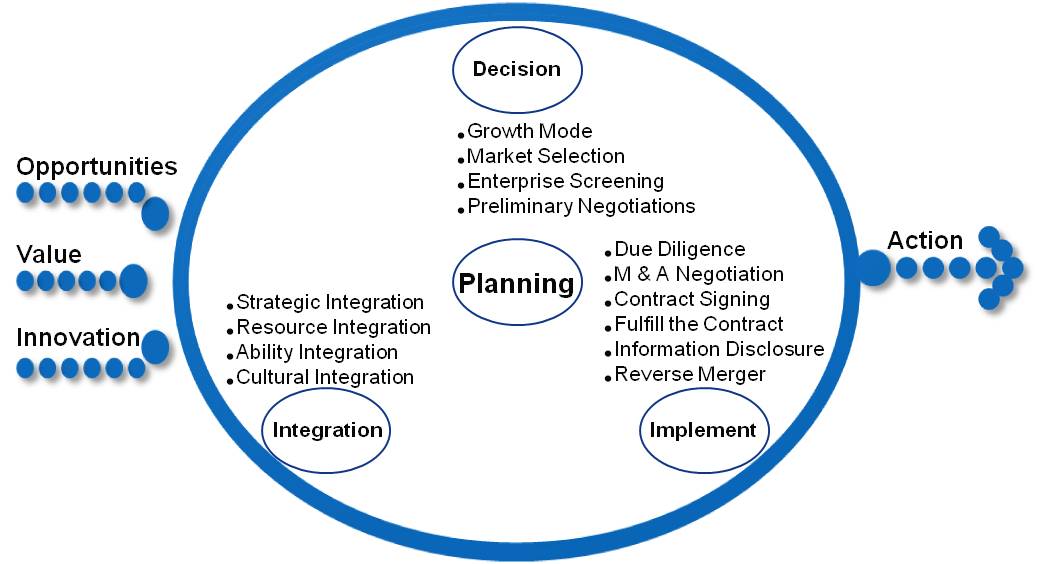

Overall framework of mergers and acquisitions consulting

Mergers and acquisitions consulting of SLEEING includes three modules – M&A decision-making, M&A implementation, M&A integration. Focus of the consultation is through the effective integration of enterprise resources, to assist the entrepreneurial organization expand the production scale through M&A, and enhance the core enterprise ability.

A. M&A decision-making consultation

As a kind of enterprise behavior under the condition of market economy, M&A has been an important way to expand production scale, enhance the entrepreneurial ability, realize great-leap-forward development. But M&A exist a lot of uncertain factors, inadequate preparation easily make the M & A began to deviate from the optimal trajectory, then no matter how precise measure matching and coordination, target enterprises to find will deviate from the ideal state, resulting waste of enterprise resources, deterioration of value, and even suffered more serious punishment.

The mergers and acquisitions decision-making consultation of SLEEING taking planning as the basis, taking consultation of growth mode selection, market selection, enterprise screening, preliminary negotiations as a means, to assist the entrepreneurial organization establish the standard M&A decision-making process, so as to avoid risk of merger and acquisition, promote cooperation and stability of M&A of all parties, enhance the performance of mergers and acquisitions.

B. M & A implementation consultation

M & A activity is both rational behavior results, both the acquirer or target enterprises have the motive and purpose. Because of the information asymmetry, moral hazard, "covert project" and the legal policy, the implementation of M & A always involves substantial risks and pitfalls. Many enterprises in the implementation of M & A process due to information collection is not thorough, risk prevention mechanism is not sound, the lack of legal consciousness, means backward, so that the enterprises after merger deviate from the ideal state, lead to the failure rate of mergers and acquisitions stayed high, and there were some M & a "massacre".

The mergers and acquisitions implementation consultation of SLEEING taking planning as the basis, taking consultation of due diligence, M & A negotiation, contract signing, fulfill the contract, information disclosure, reverse merger as the means, to assist acquirer enterprises establish the implementation system of M & A, in order to verify the information of M & A, find potential opportunities, increase the bargaining advantage, reduce and avoid risks in mergers and acquisitions, Protect M & A and reverse merger go smoothly.

C. M&A integration consultation

There are some different in strategy, resources, capabilities, cultural and other aspects between the enterprise after merger and original independent enterprises. The role of competition in the market and the market position is different too. If the enterprise after merger cannot effective integration under the new environment and the new role, M & A is not only achieve synergy effect, enhance the entrepreneurial ability, realize merger value, but may threat the whole operation efficiency and value creation of the acquirer enterprises due to the collision, confrontation and competitive between two sides of M & A.

The M&A integration consultation of SLEEING taking planning as the basis, taking consultation of strategic integration, resource integration, ability integration, cultural integration as the means, to assist two sides of M & A established the comprehensive integration system, arrange systematically the production elements of the enterprise after merger, in order to exert the potential efficacy and the market value of M&A.

Mergers and acquisitions consulting programme of SLEEING

Value of mergers and acquisitions consulting

Mergers and acquisitions consulting of SLEEING through systematic operation to help enterprises organization improve the efficiency of M&A, reduce the risk of merger, expand the scale of production, enhance entrepreneurial ability, ensure the sustainable development.